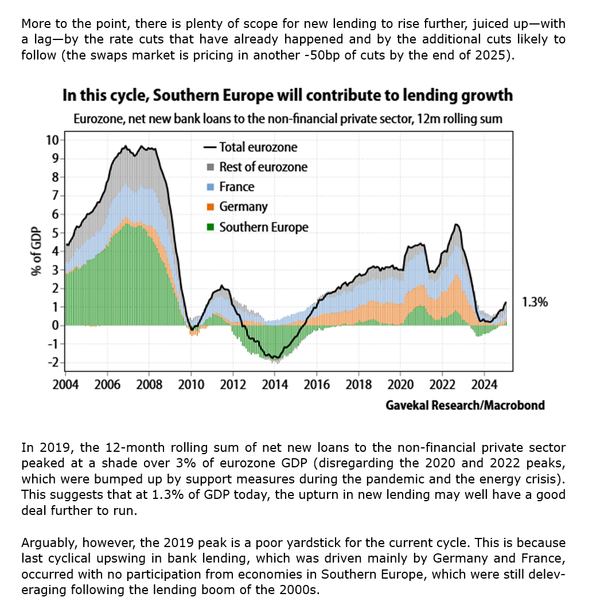

This was written about Heathrow's power outage ... but it probably applies more widely about alot of what we see in the world ... ultimately piling on layers of oversight, having multiple stakeholders and a incredible web of regulations and a lot of reports and studies on the problem (see