Not throwing away my shot ... from John Auther's (Bloomberg column) ..

Enter Alexander Hamilton. America’s first treasury secretary is in vogue thanks to the musical written by Lin-Manuel Miranda. Arguably his most lasting achievement was to persuade a dubious Thomas Jefferson to accept collectivizing states’ war debts in the federal treasury. This led to the bond market (remarkably, Jefferson even opposed the notion of being allowed to sell a government bond for a profit or loss), and to the federal United States as it exists today. Now, the financial world is awash with speculation that we have a Hamiltonian moment for the euro zone, which will bring its federalist destiny. The French and German governments have made a proposal for 750 billion euros in bonds to finance coronavirus relief that would be raised in common, not by any constituent state. The comparison is obvious. Is it justified?

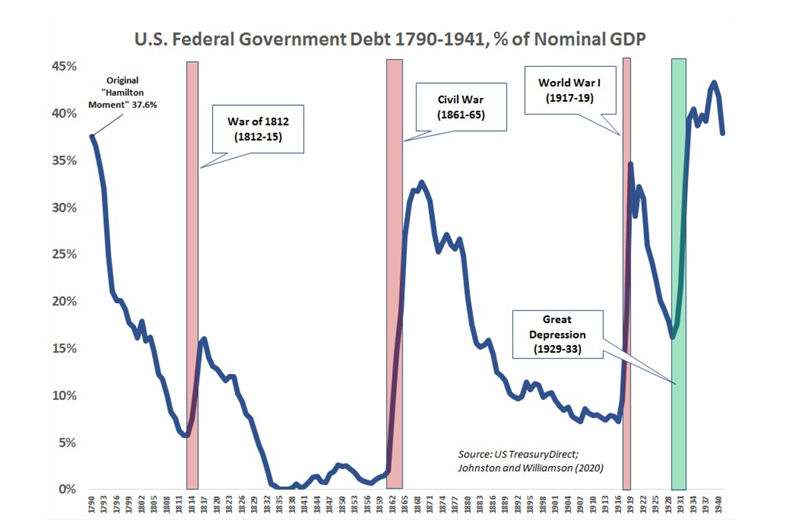

The arguments that it is are, first, that in proportion it is as big as the original Hamiltonian assumption of war debt. This chart is from a great Twitter thread by the Peterson International Institute of Economics’ Jacob Kirkegaard. He makes the point that the proposed bond raising, while only 5%-6% of gross domestic product, would in fact be as high as U.S. federal borrowing ever reached (outside of wartime) in the 130 years between the Hamilton moment and the Great Depression:

Another strong case in favor comes from Anatole Kaletsky of Gavekal Economics. First, he points out, the bonds will be issued by the EU in its own name, avoiding any confusion of joint guarantees. Second, and perhaps most important, this implies tax-raising power for the EU, beyond its current income from customs duties and a small share of value added taxes. Kaletsky suggests that this will need to be raised from "economic activities which transcend national boundaries" — so maybe a tax on carbon, financial transactions or digital activities. Finally, he points out, the proposal allows the EU to leverage itself. Interest rates are at rock bottom, so this could soon become a mechanism for dealing with far more than coronavirus relief.