Nice piece of analysis from our friends at Green Street ...

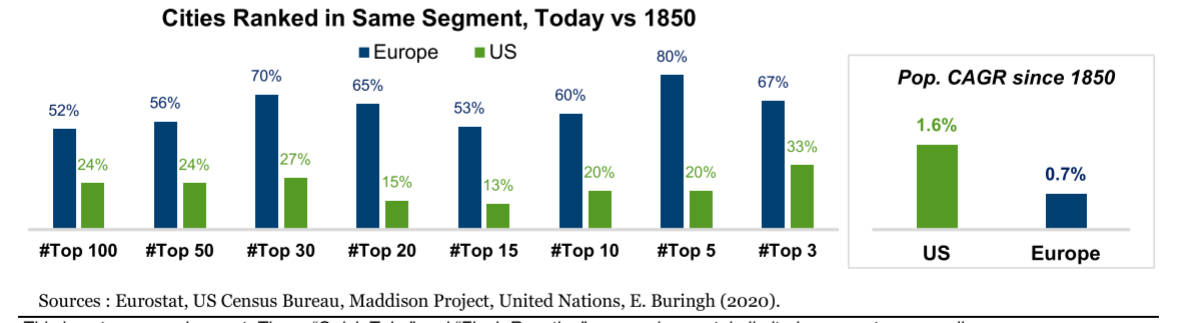

We've spoken about this alot in the past - Europe and the US behave differently when it comes to urbanisation - Europe has been slower moving but few cities have collapsed in on themselves - growth may be a bit slow but 70% of the top 30 cities are the same as they were in 1850 ... making a long run investment fairly straight forward...The US is clearly a more exciting growth story - but its equally a more challenging long run proposition ... particularly when you factor in the higher supply elasticity associated with US zoning and development control (which means new supply is delivered more rapidly in response to growth) ...Ultimately a robust real estate market needs growth over time and for that growth to outrun supply on a consistent basis ...