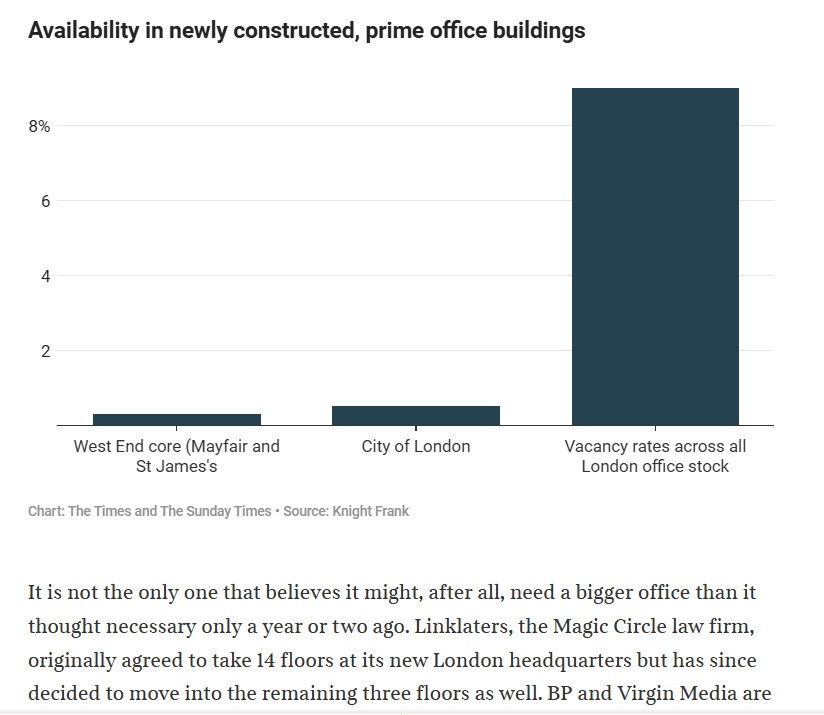

Nice article ... office is alive in Europe and the Class A end is thriving ...

People have been to quick to condemn office to the institutional wilderness ... the performance of the Class A end reflects the reality on the ground - the demand for properly amenitised, well located space in energy efficient buildings is strong ... and this quality 'cohort' represents about 30% of the space ... given a lower level of net demand (to include flex working) that still leaves us with 2 or 2.5 times more demand for this end of the market than there is space to rent ... which is why rents have been bumping on new leases.Ultimately this will ripple out and we will begin to notice an upgrade cycle starting for lower spec buildings in the right locations - particularly where values have corrected ... and by the same token we will see poor buildings in the wrong places fall out of the office market and reappear as refurbed hotel and resi locations ...It will be interesting to see how global investors react to this ... some parts of the US office market are now univestible ... and US portfolios now have to be increasingly focussed solely on the increasingly crowded logistics and resi spaces ... so we may find that Europe is the one place where globally focussed allocators can find some slightly different opportunities! https://www.thetimes.com/business-money/economics/article/why-london-offices-are-in-such-demand-fqzmbq5mk